“Southern homes for city men”: why reward and benefits can no longer live in the past

After the end of the first lockdown, there was significant pressure from government and other sources to quickly re-engage with our previous working patterns. A return to physical workplaces, onto public transport, and into city centre cafes and bars.

This time around there may not be as much immediate pressure to return when the lockdown ends. And, with near-on a year of disrupted working practices, some of the changes in our lifestyles may start to become permanent. That is already having seismic knock-on effects for many sectors. Other sectors will see stratospheric growth, and the skill sets that employees need for the future will continue to change at breakneck speed.

As a part of this cauldron of change, the way businesses reward, recognise and motivate staff cannot remain static. Many of the stalwart components of current employee benefits provision were designed to support very different lives and needs.

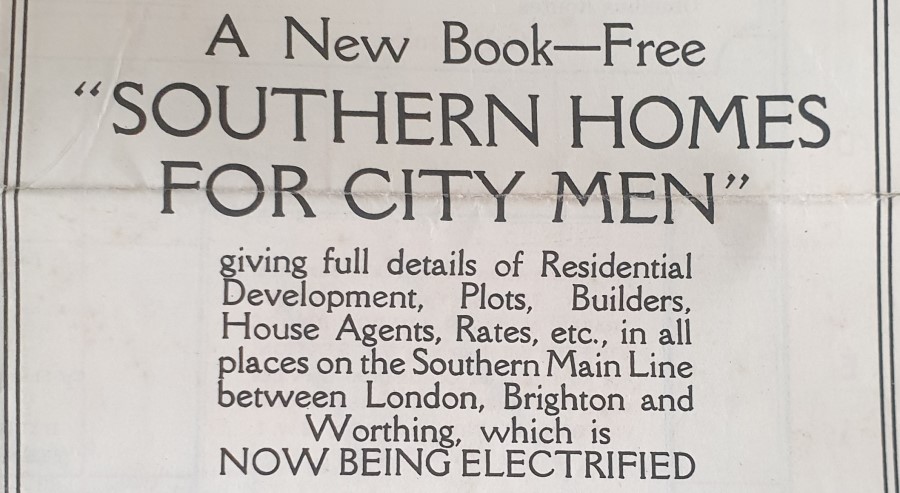

For example, the idea that work and home should be geographically separate is the reversal of a trend dating back to the Industrial Revolution. In 1800 almost all Londoners worked within walking distance of their home, but by 1900 most were travelling to work. By the early 20th century, railway companies were working hand-in-hand with builders to create the idyll of travelling into the city to work, then returning to suburban family comfort in the evenings. (The above “Southern Homes for City Men” advert sat alongside a railway map from the 1930s).

Personal finance and employee benefits evolved to support those ideals. Low-interest, small deposit mortgages made home ownership affordable for the average worker in the 1920s and 30s, for the first time. The Paid Holidays Act of 1938 gave employees more leisure time away from work, and season tickets reduced the cost of the daily commute. Demand for company pension schemes and associated life insurance increased. Pensions tax relief, to make saving for retirement more affordable, was first introduced in 1921 – and it’s still causing controversy today. Access to public transport also helped the trend for company-sponsored sports grounds out of the city, the basis for a wealth of social and physical wellbeing activities.

Many of the employee benefits we have today are rooted to a greater or lesser extent in this infrastructure, designed to motivate staff (mostly men) who travel into work, return to a family home that they own, enjoy a holiday every year, save for a very short period of retirement, and socialise with their colleagues on the cricket or football pitch.

Current trends in work and society make this picture look decidedly dated. Fewer workers, especially younger employees, have access to easily affordable mortgages in the suburbs, and the COVID-19 pandemic has forced us to understand how some of our working life can be achieved without a daily commute. The way we work and current isolation has put greater emphasis on the mental and social wellbeing of employees. Our retirement might last as long as 30 years. Women form a greater proportion of the workforce, so gender-specific wellbeing – physical, mental and financial – will become ever more significant. And, our awareness of climate change is reshaping behaviour both at work and beyond.

Employers are already beginning to recognise these changing needs. For example, REBA’s recent Pensions and Master Trusts 2020 research, in association with Scottish Widows, shows that employers want to think beyond ‘just pensions’ and have a wider financial wellbeing approach – an overwhelming 96% of respondents said that they saw value in employees having access to other forms of saving alongside their pensions. The role of responsible investment is also becoming more pressing, with our research respondents seeing this as an increasing priority.

But pensions are just one part of the wider reward and employee benefits picture that needs revolutionary change. So I ask: who is your reward and employee benefits package really designed for? Is it to motivate today’s employees and support their lifestyles – or is it an extension of a mid-20th century way of life that is fast receding into the distance? It’s time to change.

The author is Maggie Williams, content director at REBA.