Socially responsible investing: what employees are really looking for

What is it?

In a nutshell, SRI means investing in companies that are serious about environmental sustainability, social justice and good labour practices. Investors avoid specific investments whilst favouring others based on their own value system. For example, avoiding fossil fuel-based companies in favour of alternative energy initiatives.

On the ground however, it’s probably a lot simpler. Employees see it as investing in a way that’s positive for the planet or at least not damaging it. Guilt free investing?

Younger employees are more interested than older employees

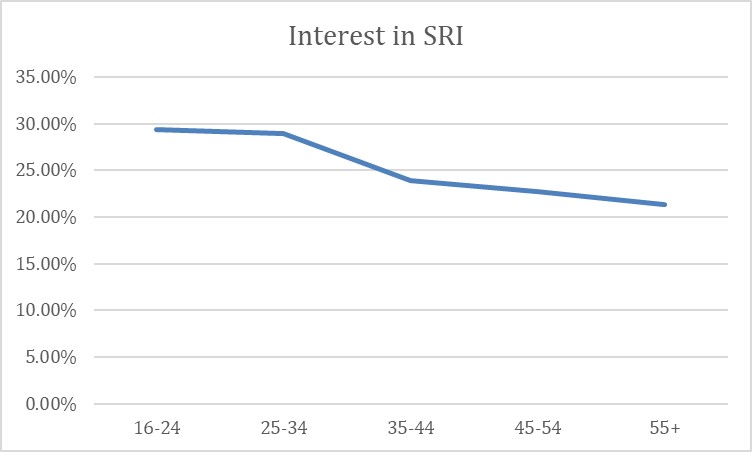

But how important is SRI to employees when it comes to their pension pots and other investments? Well it depends on age.

Our Realigning the workplace savings offering to meet the needs of millennials (2019) research shows that the older we are, the less interested we are in SRI (see below graph). Perhaps there’s an element of truth in Greta Thunberg’s accusation that “the younger generation is being let down by the older generation”?

Considering recent disasters such as the Australian fires and the continuing calls from Thunberg for world governments to address climate change, should we expect a greater level of interest in SRI, especially from millennials? After all, the climate change strikes around the world last year were really spearheaded by the younger generation.

My sense is that the level of interest is quickly growing and at some point, pure ‘interest’ will turn into ‘demand’. This is already happening at a corporate level.

Aon’s Global perspectives on responsible investing (2019) research shows the perceived importance of responsible investing in corporate pensions rising from 56% in 2018 to a massive 86% in 2019. Importance at employee level is bound to follow suit.

SRI at any cost?

Many people believe they can’t invest responsibly and invest for growth. There’s a presumption that SRI results in lower returns than more ‘mainstream’ alternative investment approaches.

But in the longer term is this true? For instance, as the world moves to lower carbon alternatives, fossil fuel-based energy businesses will surely start generating less profit and ultimately deliver reduced returns to investors?

That said, we’re in a transition period and employees need to keep an eye on their long-term investments, especially pensions. So, would they still be interested in SRI if returns are potentially lower?

For many the answer is no. In our research, nearly 33% of millennials feel that investment returns are still more important!

What do employees want?

In one word, choice. If your pension scheme or workplace savings doesn’t offer a responsible investing option, then you are potentially disengaging one in four of your employees (one in three millennials).

In offering choice, try to remain impartial. SRI is about investing based on your own personal values. Personal values across your business are likely to be as diverse as your workforce. One approach is unlikely to satisfy everyone.

This article is provided by Smarterly.

Enjoyed this article?

Try rebaLINK, our networking and due diligence platform, to ask your fellow reward professionals about their approach to SRI.

Read more about socially responsible investments.

Contact the Associated Supplier to discuss socially responsible investments.

In partnership with Cushon

Cushon is an online savings&investments platform provider, offering holistic workplace savings.