Perks that no longer work in the era of coronavirus and how to meet changing demands

Cushon's Steve Watson will be speaking on 16 September at this year's Employee Wellbeing Congress. His session will look at transforming your wellbeing strategy from pensions to workplace savings.

Season tickets, gym memberships, restaurant loyalty cards, extra holiday, cinema tickets and free coffees are just some of the employee benefits and perks that won’t hold as much weight anymore when it comes to engagement, motivation and wellbeing.

According to CIPD, 54% of adults in the UK were working from home at the start of July 2020, and it’s predicted that 37% of employees will be working from home on a regular basis once the crisis is over, compared to 18% before the pandemic. For many, that means no more commutes, so season ticket loans won’t be as in demand and, in fact, employees will be able to make savings in this area.

The Eat Out to Help Out government initiative started this month, and with many restaurants operating at reduced capacity, benefits such as money off vouchers are likely to be in less demand.

Gyms are still very restricted in terms of numbers, and many people have found the convenience and cost of online workouts to be a better option for them. Gym membership has decreased significantly, with the Gym Group reporting a loss of 178,000 customers over the past three months. Reduced gym membership fees have long been a popular employee benefit, but will the pandemic put people off returning?

Many companies offer employee discounts on leisure activities and holidays, but with the ongoing threat of local lockdowns and self-isolation when returning from certain countries, how many people will take advantage of these offers and will they be able to use them when the time comes?

What your employees want and need has changed since the start of lockdown, particularly when it comes to mental health and financial wellbeing.

What do employees want?

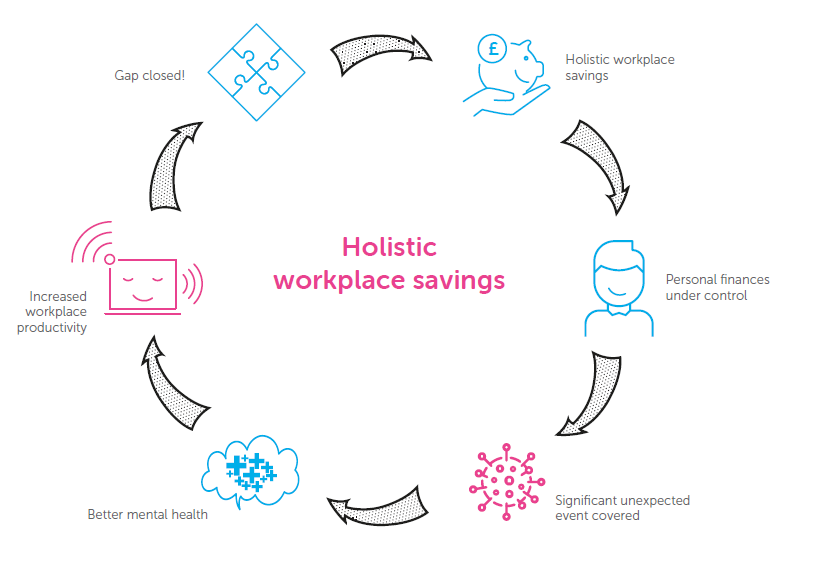

We carried out a piece of research – the coronavirus (COVID-19) crisis and financial resilience – at the height of lockdown to find out employer and employee attitudes to financial wellbeing during this time. 78% of the employees surveyed agreed that the COVID-19 crisis has made them realise that having savings to fall back on are important. Interestingly, this varied only slightly across furloughed and non-furloughed employees. The crisis has caused financial concern for the majority of employees, no matter what their circumstance.

In fact, 72% of employees felt their employer should offer some form of workplace savings scheme in addition to a pension, and 94% of employers agree.

The research findings demonstrate that now is very much the right time for organisations to be taking action to change their employee benefits packages as they stand. It may mean removing the ‘nice to haves’, which won’t be used as frequently anymore – if at all by some – and replacing them with a tangible, engaging benefit that directly impacts on employee wellbeing.

What are the barriers to giving employees what they want?

When we asked the small percentage of those who weren’t in favour of a more holistic approach to workplace savings why they felt this way, we found the main resistance came from the belief that it is up to the individual to choose to save or not. A small percentage of employers feel that employees shouldn’t be mollycoddled or in one respondent’s words “patronised”. But the fact is, the majority of employees are keen to get help from their employer when it comes to saving.

Another reason given was employees want to keep their personal and private lives separate. Offering a workplace savings scheme doesn’t mean you as the employer suddenly become involved in your employees’ finances. It’s simply a conduit to better employee financial wellbeing. The employee saves direct through payroll, but their account is personal – between them and the account provider. 58% of our respondents said that having financial worries affects their performance at work. By allowing employees to save via the workplace, you get employees who are more financially stable, which in turn can have a positive impact on productivity.

It all comes down to choice. Giving your employees the choice and tools to save via the workplace and making it easy for them. Many companies offer flex pots – this is a great way to increase employee engagement with benefits and also puts the employee in control, giving them the freedom to choose according to their personal circumstances.

Yes, restaurants, bars and other leisure and retail facilities are now open, but what about the disposable cash that your employees may have saved up over the lockdown period? For those of you that have had to put furlough in place, many of your employees who return will be concerned about protecting themselves in the future should the same thing happen.

This article is provided by Cushon.

Cushon is exhibiting at the virtual Employee Wellbeing Congress in September. You can now view the full event programme and register to attend.

In partnership with Cushon

Cushon is an online savings&investments platform provider, offering holistic workplace savings.