How to help employees manage the lifetime allowance

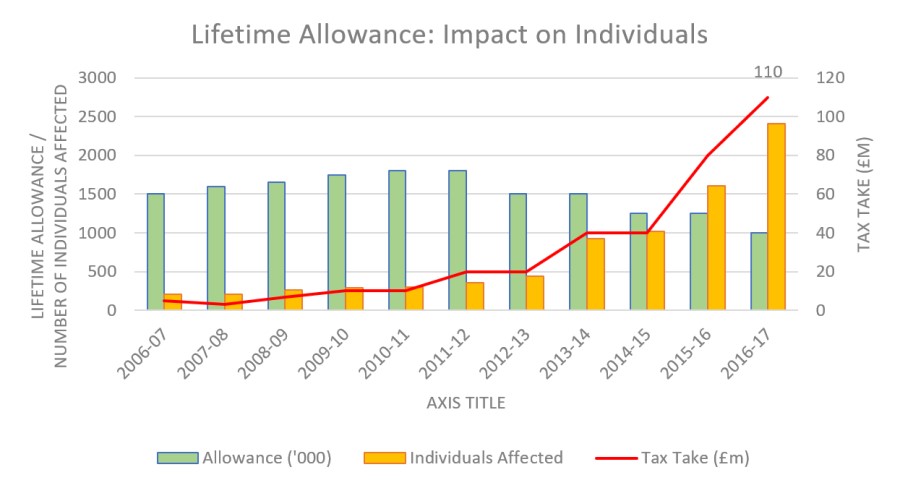

There has been a 2,000 per cent increase in the amount of tax collected from individuals breaching the Lifetime Allowance between the 2006/7 and 2016/17 tax years, from £5 million to £110 million.

The number of individuals affected has also ballooned from 210 in 2006/7 to 2,410 in 2016/17.

In graphical format, the rapid rate of change is clearly demonstrated, with the increases really taking hold since 2012/13 when the drastic reduction of the Lifetime Allowance from £1.8 million began. The current limit is £1.03 million.

No longer just an issue for high earners

With future increases to the Lifetime Allowance capped by the CPI rate of inflation, the number of people breaching the Lifetime Allowance is only likely to continue to grow rapidly.

No longer is the Lifetime Allowance a cap only affecting the wealthiest in society; more and more middle earners are being affected. Employees with reasonable amounts of retirement savings, especially where a lot of their saving are in Defined Benefit (DB) pension schemes, could easily find themselves approaching the limit, something that would have been unlikely before the steep drop in the Lifetime Allowance.

To complicate matters further, the Lifetime Allowance applies to all benefits accrued under Registered Occupational Pension Scheme rules. That is straightforward when you are only considering a person’s pension savings. However, what a lot of people may not realise is that any Group Life Assurance benefits written under a Registered Group Life Assurance scheme also fall under the Registered Pension Scheme rules.

As a result, it becomes a lot easier to reach and exceed the Lifetime Allowance when a person’s death-in-service lump sum is added to their pension savings. Suddenly people with no previous worries of breaching the allowance could find their next of kin facing significant tax liabilities should they die as a result of adding together their death-in-service benefit and their pension savings.

Alternative life assurance schemes

Thankfully there is an alternative option to Group Life Assurance benefits; an Excepted Group Life Assurance scheme. These are not registered under the Occupational Pension Scheme rules, therefore any benefits are not assessed against the Lifetime Allowance.

Especially useful for organisations providing significant death benefits for senior employees, Excepted Group Life Assurance can be a sensible way to structure the benefits. Existing Group Risk schemes can also be converted to Excepted status if required, subject to meeting the requirements for an Excepted Group Life Assurance scheme.

An Excepted Group Life Assurance scheme is a helpful way to support your employees in avoiding the Lifetime Allowance, meaning they’re less likely to be hit with a large tax bill later on.

This article was provided by Busy Bees Benefits.