Focus on productivity and efficiency: How employers should react to the increase in minimum wage

However, sectors with a large proportion of lower paid staff with tasks that are difficult to automate such as social care, retail and support services, have seen their staff costs increase more than others.

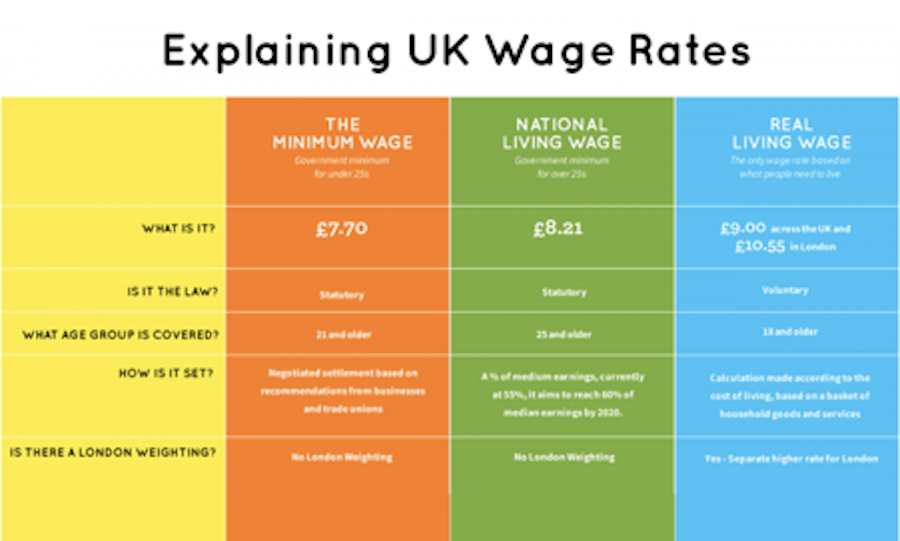

In 2016 the government introduced new legislation to give effect to the National Living Wage (NLW). The NLW is similar to the National Minimum Wage in terms of application and amount and it is expected to reach 60 per cent of median earnings by 2020.

The Real Living Wage (RLW) is calculated by the Living Wage Foundation based on what people need to get by, considering the cost of housing, transport and other core lifestyle costs. As a result, the RLW hourly rate is higher than the NLW, as shown in this table from Living Wage Foundation.

One of the simplest ways to reduce money stress for those at the lowest income bands is to pay them more. However, there will clearly be limits to how much employers can rely on this strategy.

Good money behaviour

Salary Finance’s own research has shown that staff who don’t worry about their money are likely to be more engaged, leading to less absenteeism and attrition. In addition to higher levels of base pay, employers can support lower paid employees by raising awareness of good money behaviours, habits and decisions by working with a financial wellbeing solutions provider.

There are currently over 5,000 UK employers that have adopted the RLW, including more than 1/3 of the FTSE 100 and household names including Ikea, Aviva, Nationwide and Everton FC. The Living Wage Foundation and Cardiff Business School carried out a survey of more than 800 accredited RLW businesses, ranging from SME’s to FTSE 100 companies, and found that 93 per cent reported they had gained as a business after becoming a real Living Wage employer.

Offsetting cost

To mitigate some of the direct costs of higher levels of minimum pay, employers need to have a relentless focus on improving productivity and efficiency with employees incentivised to find and implement better ways of working. A key element of that approach must be a commitment to employees’ lifelong learning and skills development and improvement.

The Work Foundation made the case well in a recent report: “The majority of people in the workforce now will still be in the workforce in 30 years’ time. As the world of work continues to evolve, so too should the way in which lifelong learning is incorporated into career paths, and the role played by businesses in upskilling and reskilling their workforce. And we must equip people….with the important transferable skills as well as the technical skills which will allow them to better adapt to change when it happens.”

As well as job-specific skills development, employees need to build a good relationship with money, so that they can make good use of their human capital in terms of how they spend, save and invest it, so they enjoy life on a day to day basis and build the financial capital they’ll need to fund life after work.

This article is provided by Salary Finance.

References

- https://www.livingwage.org.uk/

- https://www.livingwage.org.uk/news/real-living-wage-good-business-good-society

- Constructing the future: How the skills needed for success in the workplace are changing – The Work Foundation and City & Guilds Group (September 2018)

In partnership with Salary Finance Inc

We understand the impact finances have on our health, our happiness, our home life & our work life.