Being a global business opens up opportunities in insurance benefits

As requirements for transparency in corporate affairs gain greater importance, this approach enables them to leverage their multinational status to:

- Enhance governance, giving control over benefits and costs

- Ensure global compliance with the many differing and ever changing worldwide benefit regulations

- Deliver visibility of opportunities to take advantage of alternative financing methods

So how are companies successfully managing their worldwide benefit provision centrally?

Stewardship and compliance are a key part of an effective global benefits model, providing a framework for strategic review, data analysis, performance management and communication. Utilising a global broker with a central global benefits management team not only gives you access to valuable data to help you develop a strategy and governance model but can often generate significant savings through broking activity, leveraging both your and their status with global insurers.

Once you have gained that control and visibility over your worldwide employee benefit provision, opportunities open up to consider alternative financing methods. Rather than leaving the selection of insurers purely on a local basis, why not use your status as a global business and make more centrally based approaches to insurer selection. Indeed if your company already self-insures its general insurance risks then working more closely with your risk management or treasury team may open up the world of captive insurance to your employee benefit provision.

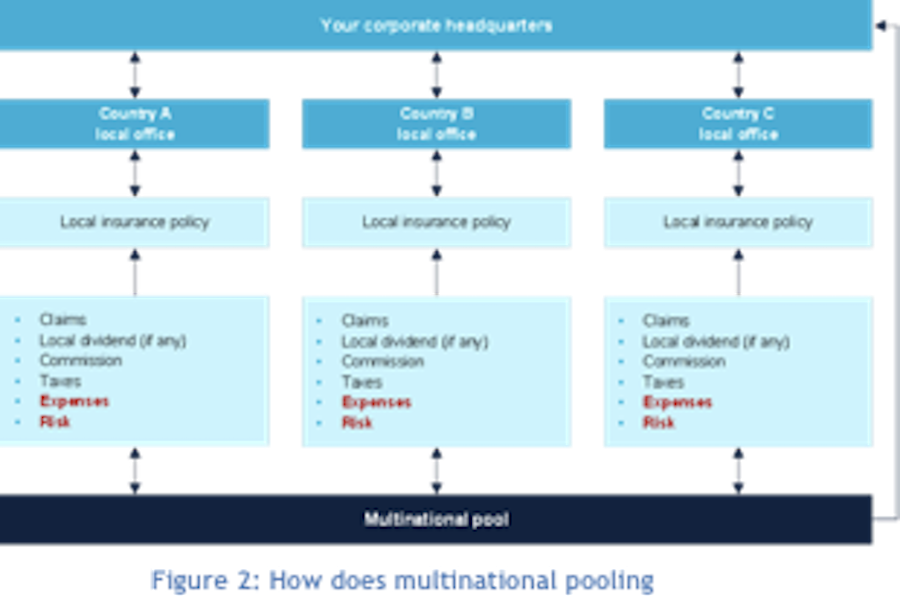

Initially you may want to remain commercially insured and therefore, depending on the level of centralisation your business is used to in other areas, you may wish to consider global mechanisms such as multinational pooling or global underwriting for your employee benefits insurances.

Pooling

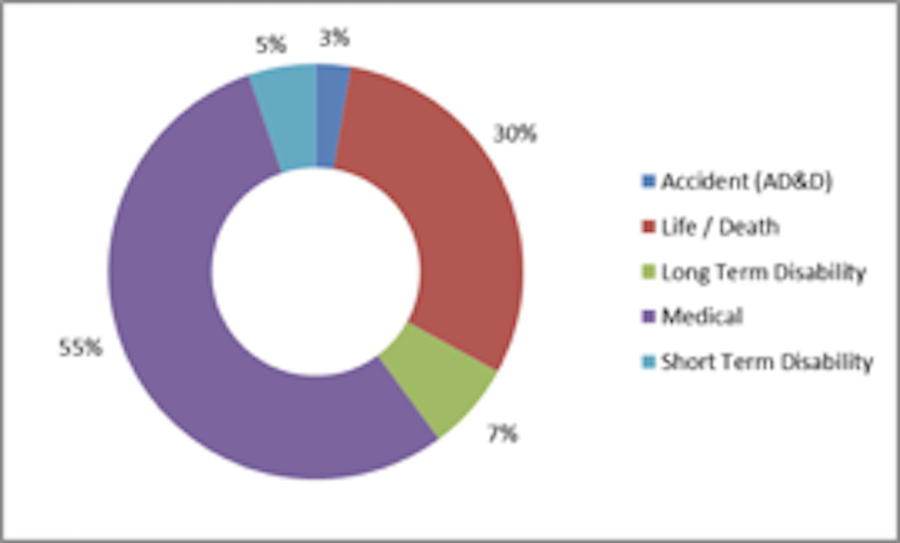

Most employee benefits insurance contracts are essentially a profit and loss account with premiums being the income and expenses and claims as the outgoings. Any profit generated (broadly premiums less expenses and claims) is retained by the local insurer. With a multinational pool, the parent company will benefit from any profit generated from a number of different policies around the world, through the payment of “dividends” and can then decide how to share the benefits with its subsidiaries. Pooling requires a coordinated and well communicated approach rather than mandatory control from the centre. However its value relies upon an overall positive claims experience, and the declaration of a dividend, the financial benefits of which are received six months into the following financial year.

Global underwriting

Global underwriting on the other hand can deliver upfront savings on premium costs due to global negotiation of pricing but required mandatory control from the centre for those countries participating. These solutions also offer other benefits including annual reporting of costs and claims activity as well potentially enhanced free cover limits for countries with smaller head counts.

Captive insurer

Alternatively does your company have a captive insurer for its general insurance risks? An often quoted statistic is 90 per cent of Fortune 500 companies have established captive insurance companies but there are many smaller companies who have done this too. It may be worth asking your risk management, treasury or finance department to see if your organisation has a captive in place.

A captive is a company’s wholly owned in–house insurance company established to underwrite its own risks. It is a sophisticated form of self-insurance providing real economic benefit and flexibility to its parent company. Historically, captive insurance companies have been almost exclusively used to insure a company’s property and casualty risks. However, a number of multinational organisations are now using captives to manage and fund the costs of their global employee benefit risks. This is either where Risk Managers are looking to diversify the risk within the captive e.g. due to regulatory issues such as Solvency II, or alternatively, where Human Resources/Compensation & Benefits teams are looking at alternative ways to manage their employee benefit coverages and costs.

When it comes to the utilisation of a captive for the provision and funding of employee benefits i.e. life assurance, accident, disability and medical, it does not change the traditional way in which many employers provide such benefits, i.e. through a locally purchased insurance policy. Premiums and claims will still be collected and settled locally on a day-to-day basis by the insurer, medical underwriting may still be required and insurer specialist services for claims management and/or policy documentation are still provided. The key difference is that the local insurer, rather than taking the insurance risk, now passes some or all of this risk onto the captive.

Utilising a captive for employee benefit risk gives you control over premium pricing, and can provide a globally consistent approach to policy exclusions, for example claims for suicide, AIDs/HIV, Alcohol/Drug abuse and passive war & terrorism that may exist on commercial insurance policies in certain countries around the world.

If you work in a multinational organisation take control of your worldwide employee benefit provision leveraging your status as a global business to improve benefit provision for your employees and manage your costs.

This article is provided by JLT Employee Benefits.

In partnership with