How to achieve better member outcomes through better default fund design

This choice has also been reflected in the default funds for international savings for companies with headquarters in those countries. However, market sentiment is quickly changing. While administratively convenient, increasing concerns are being raised about guaranteed funds as leading insurers are slashing bonus rates (in many cases to zero), before charges – risking locking members with long-term investment horizons into sustained poor outcomes.

While there are several reasons for this, it’s obvious that sustained low interest rates and falling bond yields have taken their toll. So with providers and plan members alike increasingly feeling the pain from a prolonged low interest rate environment, what are the fund characteristics that lead to better member outcomes?

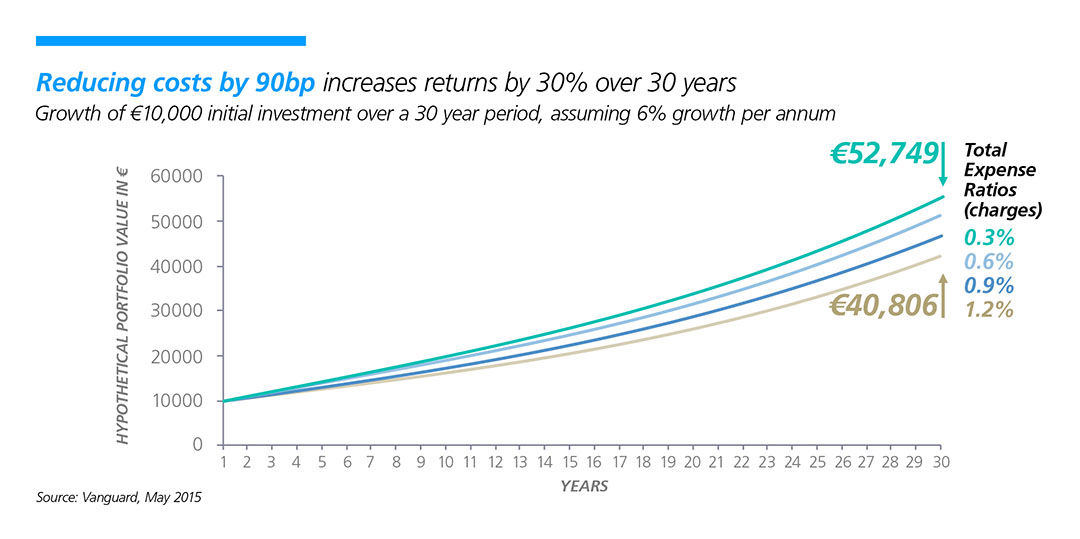

The importance of charges

Fund charges make a huge difference to member outcomes over the long term because every penny paid in charges comes out of the investment. The lower the charges the more of the investment return your employees keep – so they either end up with more, or get to their goal faster.

As a result, the best providers offer access to a diversified range of well managed funds and automated investment solutions at the most competitive and transparent commercial terms available. Increasingly, this means the inclusion of passively managed fund options within the available fund range.

Default investment design principles

However, the best investment solutions offer more than just low charges.

While plan member engagement in investment decision-making tends to be higher in the more affluent, internationally mobile market, the best investment solutions should not rely on this. They must therefore:

|

1 be simple and easily explained |

2 remove any requirement for ongoing member decisions |

3 provide interactive assistance with initial selections |

Here are two solutions that meet all of these criteria.

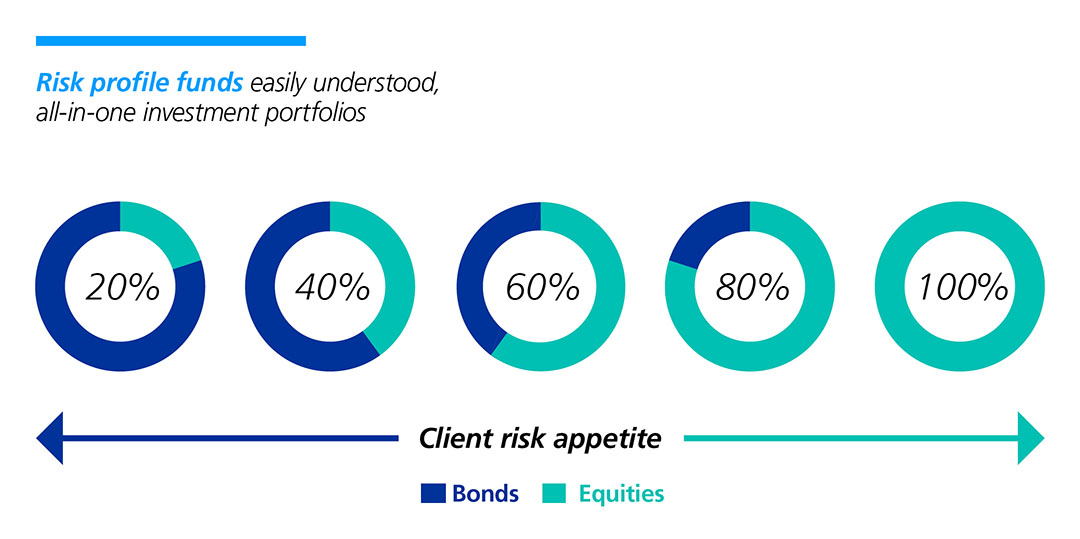

Risk profile funds

Risk profile funds have been very successful in both the US and UK. Typically, a range of risk profile funds will provide a choice of around five straightforward, risk-based and diversified investment portfolios. The funds provide exposure to a targeted mix of equities and bonds and are designed to deliver market-driven returns over the long term in a way that’s simple to understand.

If they have a passive core, they can be a simple, low-cost solution that maintains a fixed level of risk and provides broad diversification with high levels of liquidity. Risk profile funds can be used individually, collectively or within a pre-set glidepath that reduces risk as the member approaches retirement age (therefore fully automating the member’s investment journey).

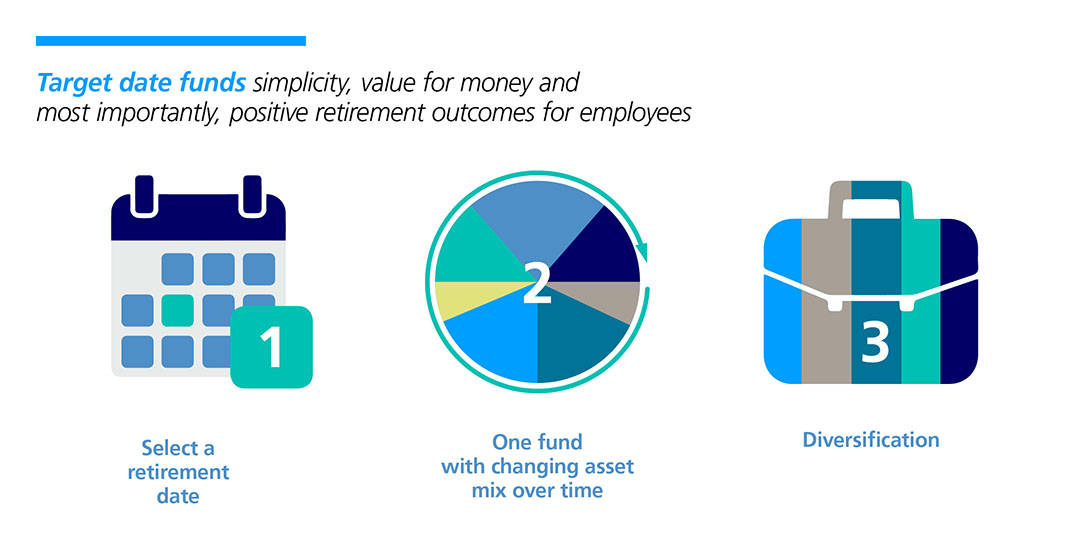

Target date funds

Target date funds are the most popular default strategy for US domestic pension plans. According to Morningstar, assets in target-date strategies totalled more than a whopping USD 1.7 trillion at the end of 2018.

With their focus on simplicity, value for money and automated glidepaths all driving positive retirement outcomes for members, it’s easy to see why target date funds are now becoming a popular default investment choice for employers with international pension plans:

|

1 Employees can invest in one fund from joining until retirement, as the asset mix will change over time to reduce risk. |

2 It’s easy for employees to select the right fund – they just need to know when they want to retire. |

3 Each fund contains a wide portfolio of investments, spreading risk through diversification. |

Time for a review?

You are providing a valuable benefit through your retirement savings plan, so it makes sense to maximise its potential, both for your employees – in terms of retirement outcomes – and for your organisation – in terms of recruitment and retention. Reviewing your existing default investment options can open up new opportunities for your internationally mobile employees to achieve the best value from the contributions made to their plan.

In our next article we will look at how international pension plans can be a cost-effective option for even small groups of employees.

This article is provided by Zurich.

In partnership with Zurich

We are one of the world's leading insurers and one of the few to operate on a truly global basis.